Japan's Nippon Steel has secured a deal to buy US Steel for $14.9 billion. According to CNBC, the agreed-upon price of $55 per share reflects a whopping 142% premium to US Steel's stock price on August 11, the final trading day before Cleveland-Cliffs proposed a $35-per-share, cash-and-stock bid for US Steel.

All-Cash Transaction Between Japan's Nippon Steel and US Steel

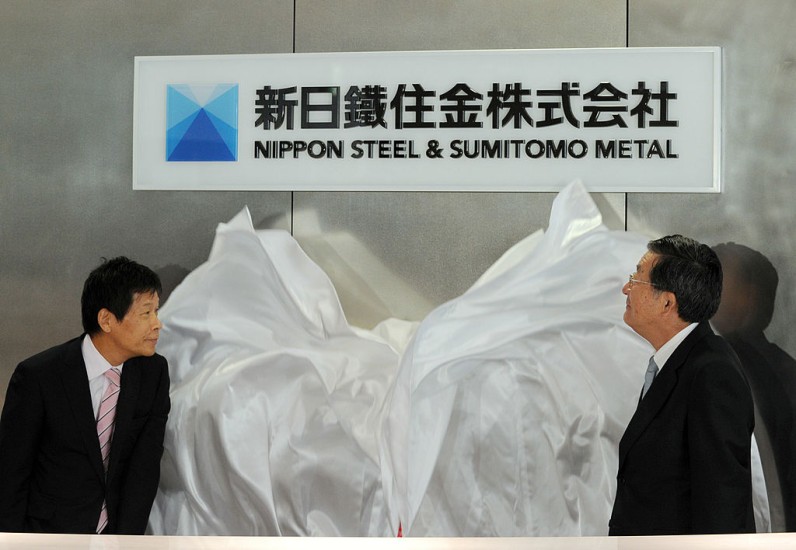

The Nippon Steel Corporation and the United States Steel Corporation jointly announced the definitive agreement on Monday.

Nippon Steel, the world's fourth largest steel maker, will acquire US Steel in an all-cash transaction at $55.00 per share, representing an equity value of approximately $14.1 billion plus the assumption of debt, bringing the total enterprise value of $14.9 billion.

The purchase price of $55.00 per share represents a 40% premium to US Steel's closing stock price on December 15, and the transaction has received unanimous approval from the Boards of Directors of both Nippon Steel and US Steel.

The deal combines world-leading technologies and manufacturing capabilities to serve customers better in the US and globally. Nippon Steel's acquisition of US Steel will also expand the geographic areas in which Japan's largest steelmaker can better serve all its stakeholders, including customers and society at large.

READ ALSO : General Motors Stock Jumps 10% as the Automaker Announces $10 Billion Buyback, Dividend Hike

Diversifying Global Footprint of Nippon Steel

The deal will diversify Nippon Steel's global footprint by expanding its current production in the US, adding to its primary geographies of Japan, ASEAN, and India.

Nippon Steel's expected total annual crude steel capacity is set to reach 86 million tonnes, aligning with its strategic goal of achieving 100 million tonnes of global crude steel capacity yearly.

"We are excited that this transaction brings together two companies with world-leading technologies and manufacturing capabilities, demonstrating our mission to serve customers worldwide, as well as our commitment to building a more environmentally friendly society through the decarbonization of steel," NSC President Eiji Hashimoto said in a joint statement.

"The transaction builds on our presence in the United States and we are committed to honoring all of US Steel's existing union contracts. We look forward to collaborating closely with the US Steel team to bring together the best of our companies and move forward together as the 'Best Steelmaker with World-Leading Capabilities'," he added.

For his part, President and Chief Executive Officer of US Steel, David B. Burritt, said: "NSC has a proven track record of acquiring, operating, and investing in steel mill facilities globally - and we are confident that, like our strategy, this combination is truly Best for All."

"Today's announcement also benefits the United States - ensuring a competitive, domestic steel industry, while strengthening our presence globally. Our shared decarbonization focus is expected to enhance and accelerate our ability to provide customers with innovative steel solutions to meet sustainability goals," he added.

Join the Conversation