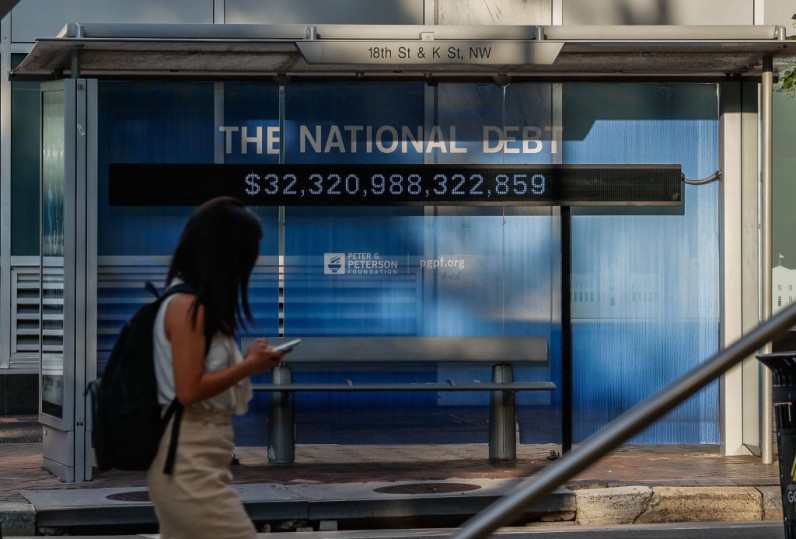

In the fourth quarter of 2023, household debt in the United States soared to $17.5 trillion, the highest in the country's history.

How to Pay Debt?

Business Insider reported that the average debt in the US is $104,215, including loans, credit card debt, and home equity lines of credit.

Across all states, California, Oregon, and Washington have the highest average debt, while Ohio and Texas have some of the lowest.

Because of such all-time high household debt rates, which have been carried over into 2024, many financial advisers have varying approaches to paying off debt, or in Dave Ramsey's case, avoiding it entirely by living within one's means.

No single approach is the right one, and it would depend on a person's capacity to earn money and personal preferences. With this in mind, MarketWatch provided several steps an American could take to pay off debt practically.

Know Whether to Start Big or Small

Not everyone approaches debt payment the same way. Some want to pay the big ones first, while others plan to start with the smaller ones and work their way up.

However, Wells Fargo head of advice relations Emily Irwin stressed that people would have to know who they are and the variables at play in a particular situation, such as the amount one owes, the type of debt incurred, and one's income and the feasibility of using it to pay for one's debt.

Ask for Financial Advice

But even if people have a hard time deciding what to prioritize, they can also consider hiring a financial planner for a one-time consultation, particularly independent advisers who charge per hour or project and are fiduciaries who promise to put their clients' interests above and before their own.

Using BrokerCheck can also help those seeking an adviser with a clean record with the regulatory organization FINRA.

Discuss Debt Management Options

After finding the right approach to paying debt and the right financial advisor to assist in such an approach, clients would have to discuss their debt management options with one's advisor and assess if it could work or if an alternative or alternative proposed by the advisor would be better.

If the advisor provided multiple approaches to debt management, Irwin suggested that clients ask for an explanation of how the advisor's favored approach works and why it would work best, as well as two other alternatives, leaving the client with the top three strategies.

If advisers are attentive, they can ask personal questions to understand their clients' financial histories and work their way from there.

READ MORE: Warren Buffett Issues Grave Warning About AI, Saying It Would Make Scams Far More Convincing, Revving Up Fraud

Join the Conversation