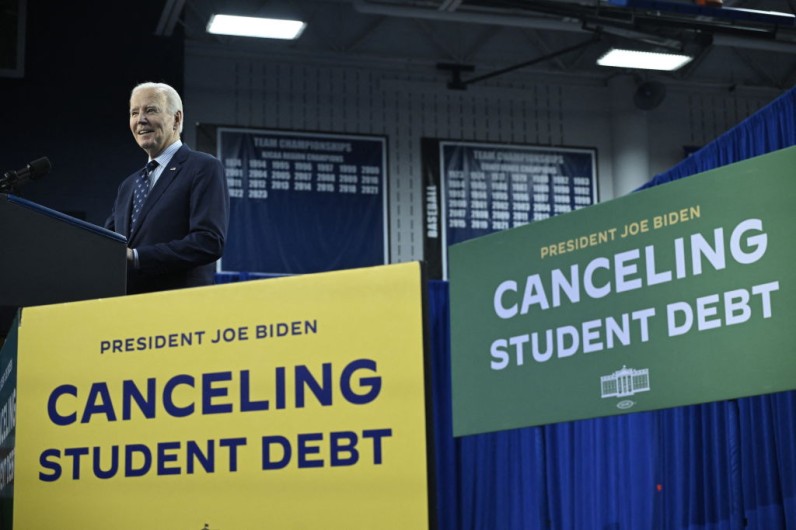

The Biden administration said on Wednesday that it will cancel $7.7 billion in student loans for more than 160,000 borrowers, in its latest move to alleviate the burden of college debt on families.

160,000 Borrowers to Have Student Loan Debt Cancelled

The relief is a result of modifications to the US Department of Education's income-based repayment programs and Public Service Loan Forgiveness program.

Wednesday's student loan forgiveness totals $5.2 billion for 66,900 borrowers seeking Public Service Loan Forgiveness and $1.9 billion for 39,200 individuals enrolled in income-driven repayment programs, according to Fox Business.

Another $613 million will be distributed to 54,300 borrowers under the Biden administration's new income-based repayment option, known as the Saving on a Valuable Education, or SAVE, plan. That option results in student loan cancellation after ten years for individuals who borrowed $12,000 or less.

The 160,000 borrowers consist of individuals who are part of the Biden administration's SAVE Plan. These borrowers primarily include public service workers such as teachers, nurses, and law enforcement officials. Additionally, there are borrowers who have been granted relief due to improvements made to Income-Driven Repayment (IDR) plans.

Biden's Campaign Aims to Strengthen Young Voters' Support

Biden has made student loan forgiveness a key focus of his campaign, intensifying his efforts to connect with young voters leading up to the upcoming election.

In a significant move, the administration recently announced the cancellation of student debt for over 277,000 borrowers. The actions specifically focused on public service workers, individuals on IDR plans, borrowers who were defrauded by their schools, and people with disabilities.

Last month, Biden also unveiled a relief plan aimed at helping 25 million borrowers. This includes individuals on IDR plans, those who took part in low-financial-value education programs, individuals facing hardship, and borrowers whose debt has increased due to unpaid interest. If the plan is ultimately approved, it is highly likely that it will face legal challenges, as per The Hill.

The latest developments are a result of the president's ongoing efforts to address the Supreme Court's ruling on his student debt relief plan in June.

Join the Conversation