The Nasdaq and S&P 500 surged on Thursday, May 23, following Nvidia's (NVDA) impressive earnings report, with nearly 1% and 0.6% increase, respectively, which gave optimism about the ongoing AI rally, per Yahoo Finance.

Specifically, Nvidia's stock soared over 7% in pre-market trading, surpassing $1,000 per share for the first time after the company exceeded Wall Street's high expectations for first-quarter earnings and raised its guidance, easing fears of slowing AI demand, according to VCPost.

More than that, the Nvidia-driven market optimism also helped counterbalance concerns about potential interest rate hikes, which had caused stocks to slip after Federal Reserve minutes indicated some policymakers were open to keeping rates higher if inflation doesn't decrease as expected.

READ NEXT : Nvidia Reports Strong Q1 2024 Revenue, Shares Valuing over $1,000 Triggering Stock Split

Nvidia Stock Market

In return, the positive results from Nvidia also lifted other chipmakers and AI-related stocks, with server makers Dell (DELL) and Super Micro Computer (SCMI) gaining about 6% and 5%, respectively.

Elsewhere, AI-driven optimism also boosted other companies. Snowflake (SNOW) shares rose 4% following a positive sales outlook, and News Corp. (NWS) saw gains after signing a deal with Microsoft-backed OpenAI to provide ChatGPT access to content from The Wall Street Journal and other titles.

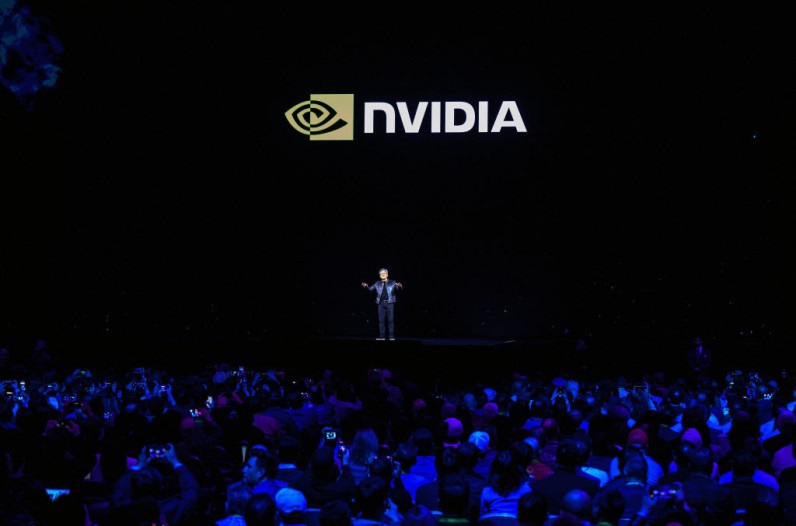

Nvidia's CEO Jensen Huang, in an exclusive interview with Yahoo Finance, emphasized the strong demand for its AI chips, stating that data centers are important for tech businesses at the moment, and AI chips are what they will need the most.

Join the Conversation