China initiated the third stage of its planned state-backed investment fund last week to boost its semiconductor industry. A filing with a government-run companies registry in Beijing revealed the funding to be worth CNY 344 billion ($47.5 billion).

Reuters reported that the figure was part of the China Integrated Circuit Industry Investment Fund, also known as the "Big Fund." This move underscores President Xi Jinping's emphasis on China's need to achieve semiconductor self-sufficiency. This strategic shift comes in the face of tariffs and sanctions by its economic rival, the United States, over its fear that advanced Chinese chips could be used to bolster its military capabilities.

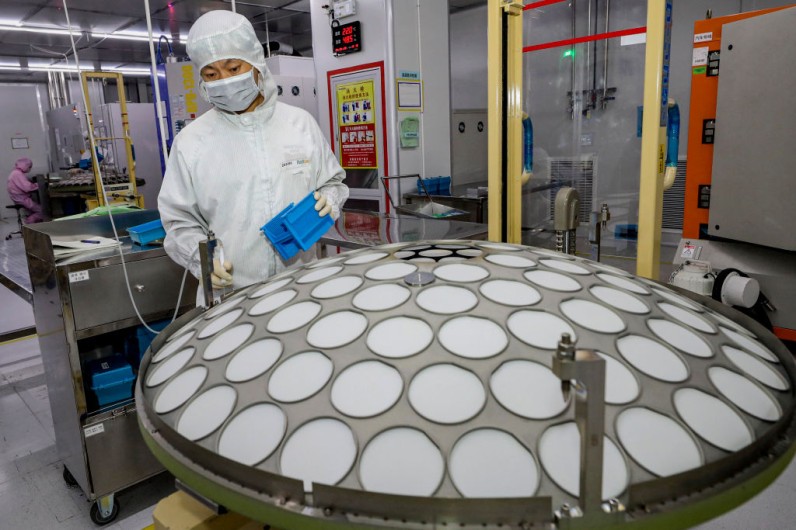

China Supports Its Own Chip Industry

According to Tianyancha, a Chinese companies information database firm, the largest shareholder of the most recent fund is China's finance ministry, which has a 17% stake in the funding and a paid-in capital of CNY 60 billion ($8.3 billion). China Development Bank Capital is the second largest shareholder, with a 10.5% stake.

Seventeen other entities contributed to the funding, including five major Chinese banks, each contributing around 6% of the total capital.

Reuters reported in September that the country would launch the third phase of the Big Fund, after it registered a capital of CNY 138.7 billion ($19.2 billion) in 2014 and CNY 204 billion ($28.2 billion) in 2019.

The Big Fund is playing a pivotal role in financing China's two biggest chip foundries, Semiconductor Manufacturing International Corporation (SMIC) and Hua Hong Semiconductor. It's also extending support to Yangtze Memory Technologies, a flash memory manufacturer, and other smaller companies and funds. This significant investment is a clear indication of China's commitment to bolster its chip industry.

Bloomberg reported a positive market response to the Big Fund's investments. The shares of SMIC and Hua Hong rose to 5.4% and 6%, respectively, on Monday (May 27). This surge in share prices reflects the market's confidence in the future growth of China's semiconductor industry.

Join the Conversation