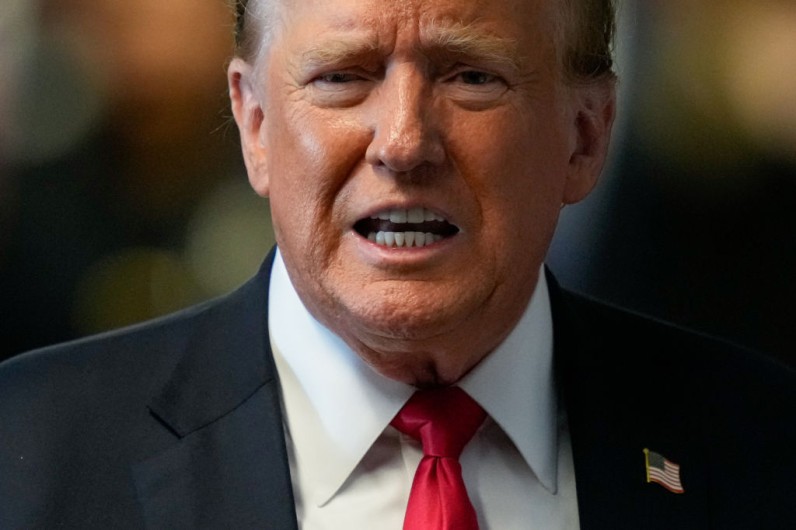

Trump Media and Technology Group (TMTG), the owner of former President Donald Trump's social media platform Truth Social, has called on Louisiana's financial regulator to investigate alleged irregularities in its share trading.

Trump Media Urges Louisiana to Investigate its Trading of Shares

According to Reuters, Trump Media CEO Devin Nunes sent a letter to the Louisiana Office of Financial Institutions Commissioner Scott Jolly, urging an inquiry into possible market manipulation and violations of Louisiana Securities Law.

The letter highlighted a surge in short selling of Trump Media shares over the past 30 trading days, resulting in a high volume of failures to deliver (FTDs).

FTDs occur when a party in a trading deal does not fulfill their trading obligations. Short selling involves borrowing a firm's shares and then selling them to later repurchase them at a lower price before returning them to the owner.

The letter cited SEC data showing over a million FTDs on 11 trading days between April 9 and April 30, peaking at more than 2.3 million on April 29. Nunes expressed concerns about potential unlawful collusion among market participants due to the "anomalies surrounding the trading of DJT." Trump Media trades under DJT on the Nasdaq.

Market Volatility of Trump Media

Since its market debut, Trump Media has experienced extreme volatility. Initial enthusiasm from Donald Trump supporters saw shares soar by 59% on Nasdaq on March 26.

However, the stock has since declined, leaving the firm with a market value of around $9 billion. The company reported $770,500 in revenue and a $12.1 million adjusted operating loss for the March quarter.

Join the Conversation