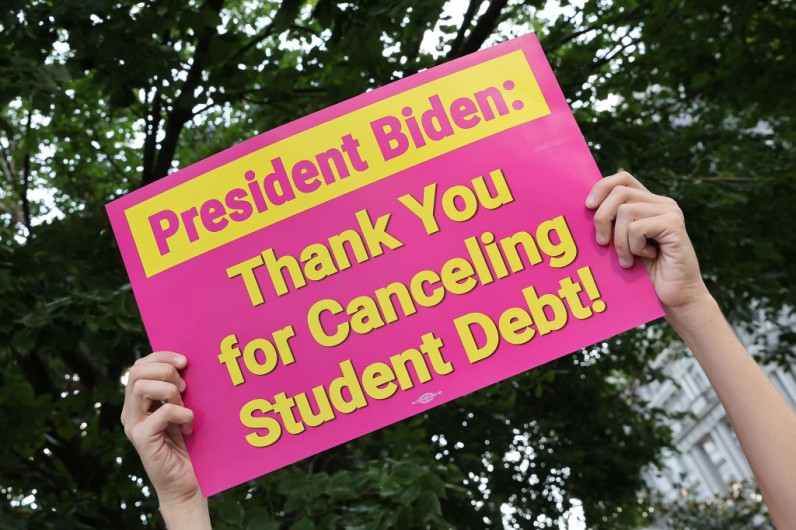

It is important for student loan borrowers to closely monitor their accounts in the upcoming months as the Biden administration continues to advance student loan relief initiatives.

Student Loan Forgiveness 2024

Adjustments were implemented to the income-driven repayment Saving on a Valuable Education (SAVE) Plan. These changes now offer borrowers who initially borrowed $12,000 or less the opportunity to have their loans fully forgiven after a decade of repayment.

On Wednesday (May 29), the Biden administration made an announcement regarding the approval of an additional $7.7 billion in loan debt relief for 160,500 borrowers.

According to the Department of Education, the total amount of debt forgiveness will now reach $167 billion for 4.75 million student loan borrowers, which accounts for approximately 1 in 10 debt holders.

In addition, the administration is actively working to reach out to eligible borrowers and expand the enrollment in the SAVE plan, USA Today reported.

Currently, there are 7.7 million borrowers enrolled in the program, with 4.3 million of them having $0 payments, as reported by the Department of Education.

READ NEXT : IRS Free Tax Filing Tool Launch Triggers Intuit Share Drop as TurboTax Loses 1 Million Free Users

Factors Affecting Student Loan Access

If you're looking to secure funding for higher education, you have the option to submit an application for either private or federal student loans. Qualification factors for private student loans can vary depending on the lender. Private student loans often have stricter credit requirements compared to federal student loans, which are based on borrowers' needs.

According to Investopedia, qualifying for federal student loans is generally more accessible, although certain criteria must be met. Understanding the eligibility requirements and potential disqualifications for federal student loans is crucial when seeking financial aid.

Choosing not to complete the FAFSA

Possessing a criminal record

Being a non-U.S. citizen or ineligible noncitizen

Lacking a Diploma or GED

Lack of Satisfactory Progress

Previous Student Loan or Grant Refunds Default

Failure to Meet Additional Baseline Eligibility Criteria

Join the Conversation