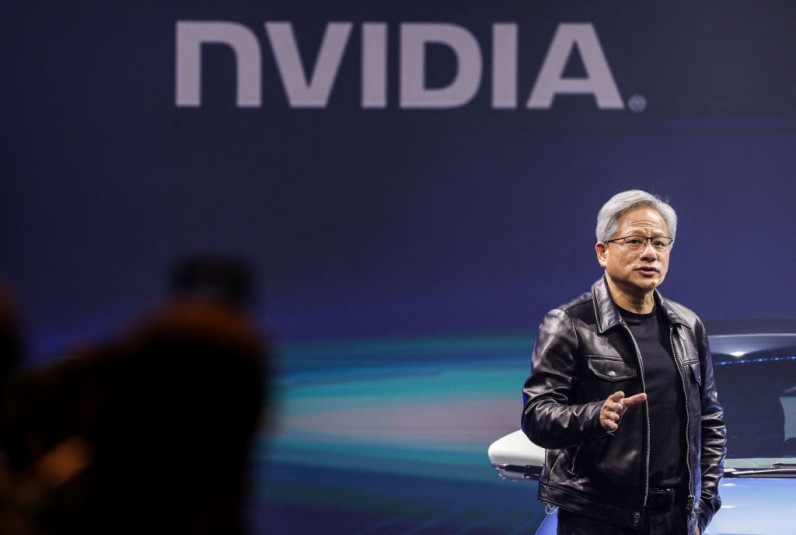

Markets on Wall Street showed a mixed performance early Tuesday, June 25, after seeing a third consecutive decline for Nvidia. Fortunately, the billion-dollar chipmaker was able to bounce back after Nvidia's stock rose by 2.2% before the market opened, recovering some of its recent losses as the frenzy over artificial intelligence seemed to cool, according to AP News.

The company's stock had declined since it briefly surpassed Microsoft as Wall Street's most valuable last week, dropping nearly 13% over three days. Due to this, VCPost has recently learned that Microsoft has regained its title from Nvidia.

However, Microsoft shares remained flat after the European Union accused the tech giant of violating antitrust rules by bundling its Teams messaging and videoconferencing app with its business software.

Nvidia Stocks in the Future

The decline in Nvidia and other AI-related stocks has had a major t impact on the Nasdaq composite, which fell by 1.1% to 17,496.82. This suggests that investors are re-evaluating the high valuations of AI stocks, which have been driving the market's gains recently. Nvidia, being a key player in the AI industry, is particularly affected as its stock performance heavily influences market sentiment towards the sector.

For Nvidia, this decline could signal a short-term setback in investor confidence and may lead to increased scrutiny of its growth prospects and valuation. While the overall market performance is mixed, with the Dow Jones Industrial Average rising by 0.7% to 39,411.21, Nvidia's downturn is equivalent to raging concerns about the AI sector's ability to maintain its rapid growth.

Join the Conversation