A federal appellate court ruled on Sunday, June 30, that key aspects of President Joe Biden's student loan repayment plan can remain in effect while lawsuits challenging it make their way through the legal system.

This allows the administration to reduce certain borrowers' payments by up to 50%, a benefit that was previously scheduled but blocked.

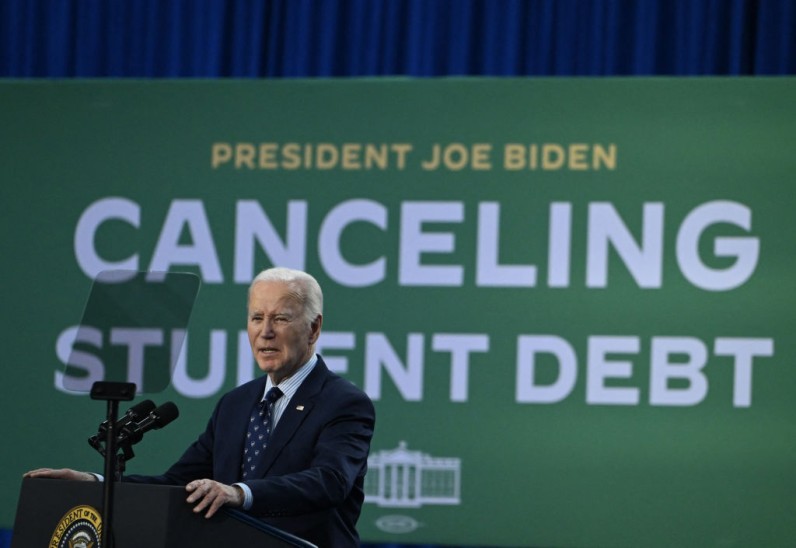

Court Allows Biden's Student Loan Repayment Plan to Move Forward

The recent order from the US Court of Appeals for the 10th Circuit in Denver adds another layer of complexity to the ongoing saga that started last week when two federal judges temporarily halted certain aspects of the SAVE plan.

The program, with approximately eight million enrollees, links borrowers' monthly payment amounts to their income and household size, according to The New York Times.

In response to the Kansas district court's injunction, the Education Department announced on Friday, June 28, that it will temporarily suspend monthly bills for borrowers in the SAVE program who are currently obligated to make payments.

This pause will allow the department to reassess and adjust the payment amounts accordingly. Over four million borrowers with low incomes are eligible for monthly payments of $0. In a recent court filing, the Education department revealed that over 124,000 borrowers have already been notified of their new, reduced payment amounts.

With the recent temporary lifting of the Kansas injunction by an appeals court, the Biden administration is now able to proceed and implement the remaining components of the SAVE program.

This includes the planned reduction in payments for undergraduate borrowers, all while the administration continues to appeal the preliminary injunction.

Last week, federal judges in Kansas and Missouri blocked much of the administration's student loan repayment plan, which was supposed to take effect on July 1.

According to AP News, the reduced payment threshold has been affected by these rulings. The recent ruling allows the department to proceed with the already calculated reduced payments as it continues to pursue an appeal.

According to Persis Yu, the deputy executive director of the Student Borrower Protection Center, the recent rulings have made it challenging for borrowers to navigate the current environment.

READ NEXT : Silvergate Bank to Pay $63 Million to Settle State and Federal Probes After FTX Collapse

Biden Administration's SAVE Plan

The center, which is dedicated to advocating for the elimination of student debt, highlights the difficulties faced by borrowers. According to Yu, the temporary stay granted by the 10th Circuit has left numerous borrowers uncertain about their future financial obligations.

Last year, the Biden administration introduced the SAVE plan as a replacement for other income-based repayment plans provided by the federal government.

Many individuals were able to qualify for reduced payments, and those who had made payments for a minimum of 10 years and initially borrowed $12,000 or less were eligible for loan forgiveness.

US Education Secretary Miguel Cardona emphasized the Biden administration's dedication to addressing the issues with the student loan system and increasing college affordability for Americans.

The appeals court ruling has no effect on the injunction issued by a federal judge in Missouri. This injunction prohibits the Education Department from forgiving loan balances in the future.

The injunctions have been issued in response to legal actions brought by states led by Republican officials who aim to invalidate the loan forgiveness program implemented by the Biden administration. This program was initially introduced in the summer of 2023 and has resulted in the cancellation of loans for at least 150,000 borrowers.

The states involved in the lawsuit contended that the administration's plan was a way to bypass the Supreme Court's rejection of the initial student loan forgiveness plan earlier in the year.

Join the Conversation