ALEX, a crypto project building decentralized finance (DeFi) on Bitcoin, is back in full force after being attacked in May, which resulted in unauthorized access and subsequent loss of funds—a proof of ALEX's determination and commitment.

The rebuilding efforts started with the ALEX token migration, which began in the first week of this month. As a result, those who are on-chain ALEX holders are to migrate their tokens to the new multisig smart contract. Notably, migrating over 10K ALEX tokens will involve a 24-hour wait as a security precaution. Meanwhile, no action is required for those who are holding their tokens on a CEX.

Since then, the platform has also reopened unaffected liquidity pools (LPs), while affected LPs can claim their recovered assets. Both affected and unaffected pools have been reopened, and so have ALEX staking, except for atALEX, which has been upgraded to LiALEX as the second liquid staking token offered by LISA. The Treasury Grant Program has been made accessible to all the affected users.

As the farming for all LPs reopened, trading volume on ALEX started recovering. By recording more than $40 million in volume in under three weeks, ALEX has shown great commitment to "coming back stronger than ever" with the help of its community's staunch support for the protocol.

As part of the rebuilding, ALEX has also distributed all accrued and unclaimed farming rewards to 5,142 wallets.

Amidst these rebuilding efforts, the ALEX incident investigation, facilitated by blockchain sleuth ZachXBT, revealed that Lazarus Group may have been involved in the attack.

"There is substantial transaction evidence linking the attack to the Lazarus Group, a notorious hacker collective believed to be associated with the North Korean government," posted the project on X (Twitter) while sharing the latest update on the attack.

The company is currently contacting international law enforcement and cybersecurity experts to recover lost assets. Affected STX tokens remain frozen on crypto exchanges, and they will stay that way as the Singapore Police Force conducts its investigation. The Foundation will announce as soon as these frozen funds can be returned to the affected users.

"We deeply regret the distress this incident has caused our community. We are fully committed to restoring the integrity of our platform and ensuring such breaches do not recur," said the ALEX team and implemented enhanced security measures to fortify the platform against similar and other kinds of threats.

Leading the DeFi Innovation on Bitcoin

ALEX first started exploring the idea of DeFi on Bitcoin in 2021 with the aim of creating best-in-class financial apps covering everything from BTC lending and borrowing to token launches and DEXs.

ALEX DeFi has utilized Stacks, a Layer 2 built on top of the Bitcoin blockchain, for its Automated Liquidity Exchange, which intends to unlock the trillion-dollar potential of Bitcoin. One of the most popular projects in the Bitcoin space, Stacks expands the functionality of leading networks by enabling smart contracts and dApps.

While Stacks dominates the Bitcoin dApp narrative, ALEX is the leading project on Stacks and, prior to the incident, had over $100 million in total value locked (TVL), as per DeFi Llama. However, even today, ALEX remains the largest DEX on Stacks and recently shared its strategic roadmap that will enhance the ecosystem's value and utility.

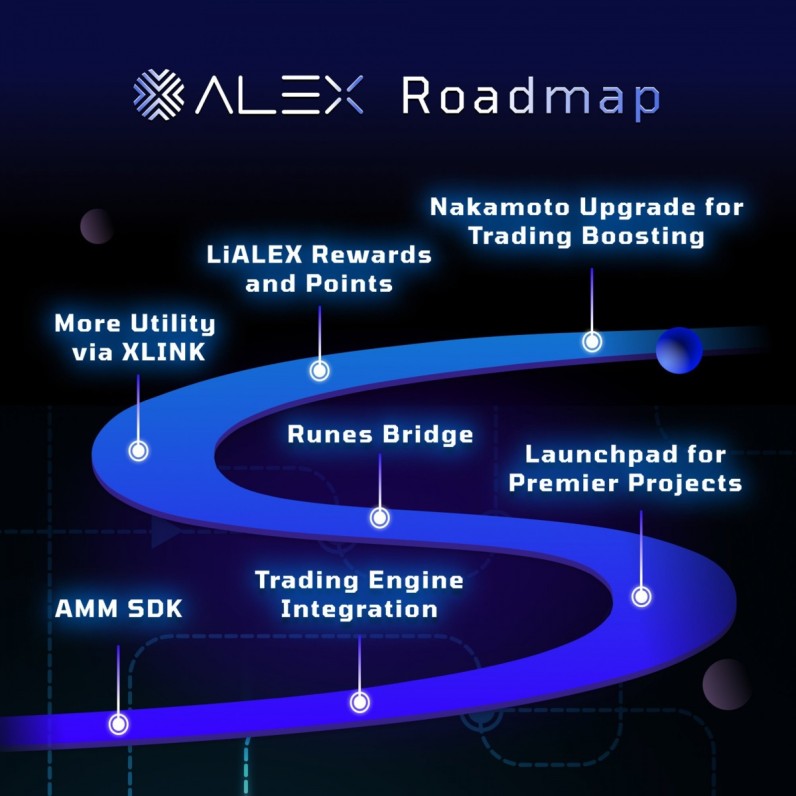

The upcoming plans for ALEX involve aligning with Stacks' upcoming Nakamoto upgrade. One of the most anticipated developments, the upgrade, will enhance the transaction capabilities of the ALEX platform significantly by introducing faster block times, hence increasing platform efficiency and a more refined user experience.

But this is not all. ALEX has also introduced its AMM SDK to facilitate seamless trading for ecosystem projects, which will boost the DEX trading volume, leading to higher revenue generation for holders.

The ALEX launchpad, meanwhile, will focus on top-tier projects, with Runes IDO already highlighting its dedication to bringing high-quality projects into the ecosystem. The Runes bridge will also be reopened to facilitate seamless token transfers and trading activities, thereby supporting Runes' growth and adoption in the ALEX ecosystem.

The project further plans to leverage the power of liquid staking with LiALEX to produce more utility and earning capabilities. The versatile LiALEX will then be bridgeable to different Bitcoin L2 solutions via XLink, expanding its utility to DEXs and lending protocols.

So, with ALEX gradually coming back to normal operations, recording increasing usage, and having a robust plan, the platform is fully committed to leading innovation, driving growth, and delivering value to its community.

Join the Conversation