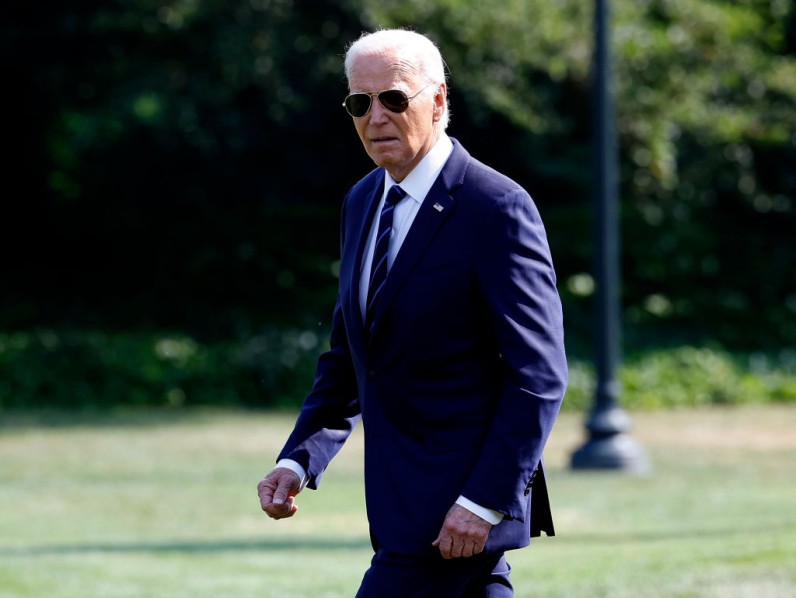

With the announcement of US President Joe Biden withdrawing from the presidential race over the weekend, it is understood that the stock market, as well as inflation and interest rates, would experience immediate impacts in the lead-up to the election in November.

GoBankingRates provided several immediate impacts that would affect Wall Street and other financial institutions.

Stock Market Impacts

For the stock market, there are five possible impacts that would affect stock markets.

Some experts have argued that Biden's exit would immediately increase market volatility.

In the immediate response to Biden's announcement, Bolvin Wealth Management Group president Gina Bolvin expressed concern that the significant change in the presidential race would present an unprecedented political uncertainty.

Impact Health USA CEO Josh Thompson and WinCap Financial founder and CEO Michael Collins both said that investors usually prefer stability and predictability, and that any significant political shift, such as Biden backing out from the presidential race and the possibility of another Trump term, would disrupt both. Some of the initial responses he identified include a sharp decline in stock prices as investors seek to hedge against potential risks

Specific sectors would also be affected, such as US equities.

Orion chief investment officer Timothy Holland said that Vice President Kamala Harris, who has since been endorsed by Biden to take his place in the presidential campaign, could be perceived to be a weaker candidate against Trump. However, he also explained that a political shift could be helpful in the US economy and help push stock prices higher.

On the other hand, Veda co-founder Stephanie Vaughan added that Biden's exit in the presidential race meant positive consequences for the US equities market.

Precious metals like gold and silver is another sector that would possibly benefit from Biden's exit.

American Institute for Economic research senior economist Peter Earle said that any reaction that would follow would be based on the specific candidate.

Bonds and crypto could also be affected by the political shift following Biden's intention to retire upon the end of his term.

According to Holland, post-presidential debate bond yields ramped up and bond prices decreased as Wall Street is anticipating a Republican Election Day victory and a likely extension of the Trump Tax Cuts, as well as an increased government spending in the defense sector.

Meanwhile, Vaughan explained that there might be a rally in the crypto markets in the wake of Biden's dropout.

Impacts on Inflation, Interest Rates

Two other factors that would be affected with Biden's exit are inflation and interest rates.

Inflation has been a critical concern for Americans in recent years, which generally took a hit in the cost of living. However, addressing inflation is a complicated matter as it would require not only market analysis but also political insight and the relationship of the two and other factors.

Inflation could also have an effect on student loan debt and inflation.

On the other hand, interest rates would remain stable for the time being.

Collins explained that Biden's exit in the presidential race would not significantly impact interest rates, saying that any changes in interest rates were primarily driven by economic factors and decisions made by the Federal Reserve and not by the individual political candidates.

With that said, however, a potential longer-term impact could gradually be experienced since, as Earle explained, if the replacement candidate was known to favor government spending, rates could be affected sooner than later.

Join the Conversation