The Internal Revenue Service (IRS) has finally collected tax returns for 2023, unless someone has requested an extension until October 2024, with the deadline closing on Monday, April 15.

But how do you know if you have unclaimed payments and how do you claim them?

Deadline for Claiming Tax Refunds

The IRS said on March 25, 2024, that more over $1 billion in tax refunds for tax year 2020 remain unclaimed, affecting 940,000 individuals. The average median refund for 2020 is $932.

The agency has conducted a particular state-by-state computation to determine how many people are potentially eligible for refunds. Taxpayers have until May 17, 2024 to file their 2020 tax forms and claim the money.

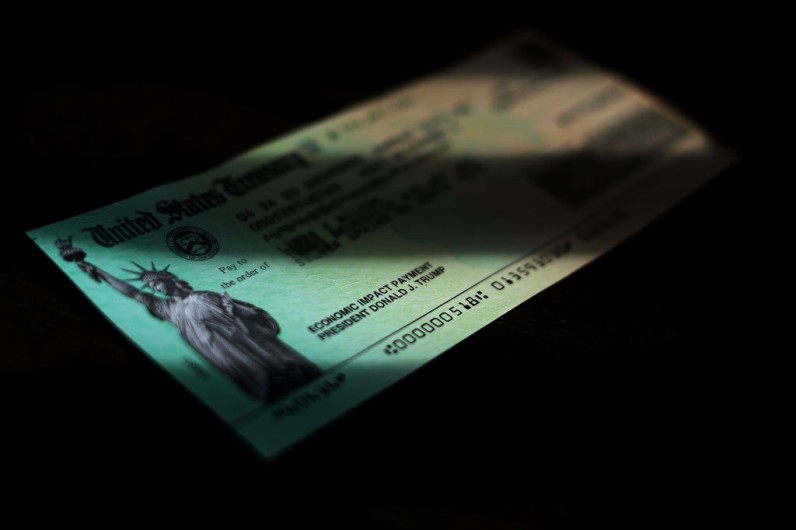

According to Marca, the IRS may owe you a Recovery Rebate Credit if you qualified for the COVID-19 stimulus check. So make sure you're examining all options to see how much you can get back.

Taxpayers usually have three years to file and recover their tax refunds. If they do not file within three years, the funds become the property of the United States Treasury.

Under normal conditions, the three-year period would have ended on April 15, 2024, which is this year's tax deadline. However, due to the pandemic, taxpayers were given more time than usual to file their 2020 tax forms and get their refunds.

That's why the three-year period was extended to May 17. On February 27, 2023, the IRS released Notice 2023-21, which provided legal guidance for claims filed by the postponed deadline.

READ NEXT : Innocent Female Uber Driver, 61, Shot Dead by 81-Year-Old Ohio Man Who Was Targeted by Scammers

How to Get Unclaimed Tax Refunds From the IRS?

Now, the government wants to reach out to people who often do not receive refunds, according to Go Banking Rates.

To file past-due taxes, call 800-829-1040 or 800-829-4059 to talk with an operator and agent who will guide you through the procedure.

Likewise, fill out Form 4506-T Request for Transcript of Tax Return and check the box on line eight. The IRS can also request and order guides for properly filing taxes by calling 800-TAX-FORM (800-829-3676).

Attorneys and tax specialists can also be called, who will walk you through the regulations and eligibility and exclusion requirements to determine whether you are entitled money, however they may charge a fee for this.

Join the Conversation