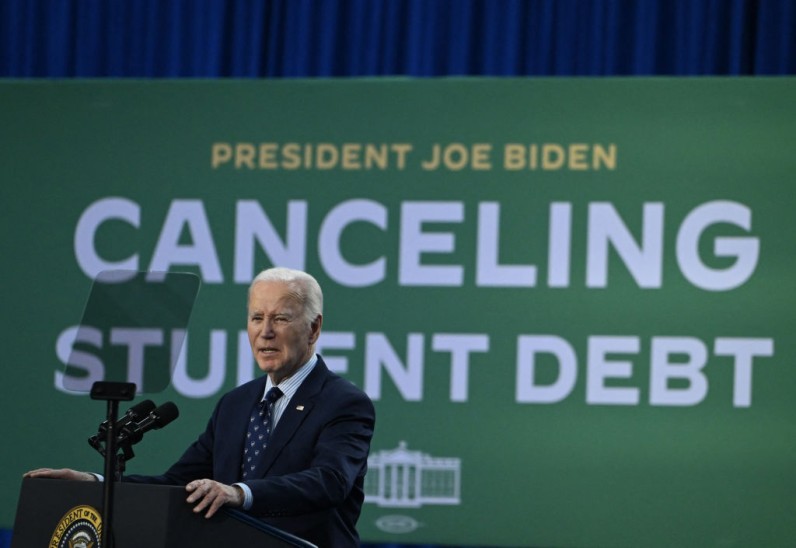

A significant blow to US President Joe Biden's student loan relief plan was delivered on Monday when two federal courts decided to partially ban a portion of the $160 billion plan.

Federal Judges Block Biden's New Student Loan Relief Plan

On Monday (June 24), two federal judges in Kansas and Missouri sided with a number of states governed by Republicans, preventing the Democrat from advancing a significant student loan relief program.

Almost 4.6 million borrowers have already received relief totaling approximately $160 billion from the administration.

US District Judge Daniel Crabtree of Wichita, Kansas, halted the US Department of Education from implementing certain portions of a plan that was scheduled to go into effect on July 1 and was intended to provide millions of Americans with faster loan forgiveness and cheaper monthly payments, Daily Mail reported.

The ruling came just before US District Judge John Ross in St. Louis, Missouri, announced a preliminary injunction that prevents the department from providing additional loan forgiveness under the administration's Saving on a Valuable Education (SAVE) Plan.

Eight million people have already used this method, and more than half of them have paid nothing at all. The Biden administration came up with the proposal after the Supreme Court overturned its first loan forgiveness program. The White House is required by the rulings to cease waiving federal student loans for enrolled students.

Student Loan Relief Halted

Both of the rulings are still preliminary, and although student-loan forgiveness is currently blocked, the courts have not yet issued their final decisions.

According to Business Insider via MSN, Judge Daniel Crabtree, who issued the Kansas ruling, had initially expressed doubt regarding the case presented by the GOP attorneys general.

On June 7, he determined that only three out of the original eleven states had the legal standing to contest the plan.

However, these two rulings are disappointing for borrowers who had high hopes for the SAVE plan that the Education Department has been promoting for the past year.

As the department keeps going to provide relief for borrowers via one-time account adjustments, it is anticipated that its broader plan for debt cancellation, which aims to benefit over 30 million borrowers, may face legal challenges in the coming months.

Join the Conversation