New Street Research has issued a rare downgrade for Nvidia, the leading semiconductor manufacturer known for its AI technologies, citing valuation concerns, as reported by CNBC. This is after Wall Street Analyst Pierre Ferragu lowered Nvidia's rating to neutral, indicating he sees little room for future growth.

He said for Nvidia's stock to do much better, its future prospects beyond 2025 would need to improve dramatically, which he doesn't think will happen soon.

Ferragu also mentioned that Nvidia's revenue growth is expected to slow down massively, with graphics processing unit revenues projected to increase by just 35% next year.

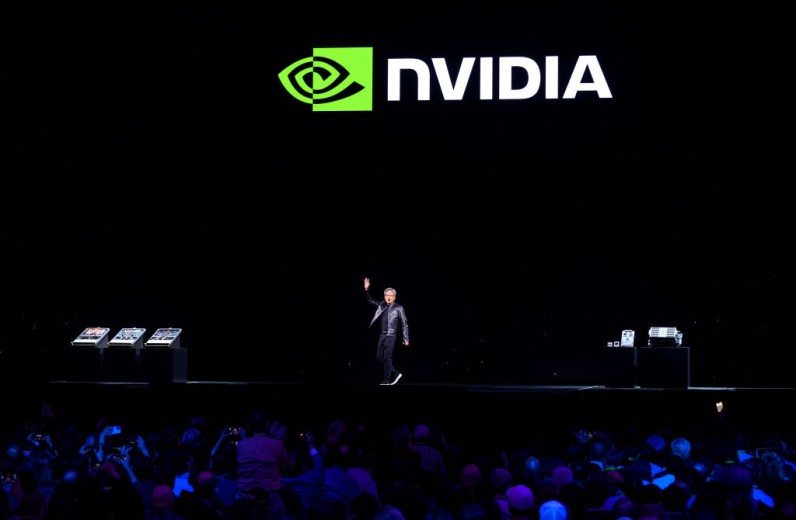

Nvidia's stock has surged impressively by 159% this year, boosted by a surge in AI-related investments since late 2022.

READ MORE : Nvidia Stock Recovers by 2.2% Following Three-Day Decline Due to Fluctuating AI Interest

Nvidia Stock Decline

However, there has been a pullback in recent weeks as investors have made profits, according to VCPost.

Negative sentiments towards Nvidia are unusual on Wall Street, where 38 out of 41 analysts rate the stock as a buy, with the remaining three opting for a hold. Notably, no analysts currently rate Nvidia as a sell.

In response to these concerns, New Street Research has set a price target of $135 for Nvidia, assuming a multiple of 35 times earnings, consistent with valuations in 2019 and early 2020. This target suggests a modest 5% upside from Nvidia's closing price on Wednesday, July 3.

Ferragu cautioned that Nvidia's price-earnings multiple, currently standing at 40 times the next 12 months' earnings, may face downward pressure. He noted that this multiple had dropped to 20 times in 2019 during a period of slower growth.

Despite these valuation concerns, Ferragu reaffirmed Nvidia's strong franchise quality and indicated potential interest in buying back shares during periods of extended market weakness.

Join the Conversation