The extension of expiring provisions from the 2017 Tax Cuts and Jobs Act would predominantly benefit higher-income households, accounting for over 45% of the total benefits, according to an analysis by the Urban-Brookings Tax Policy Center released on Monday.

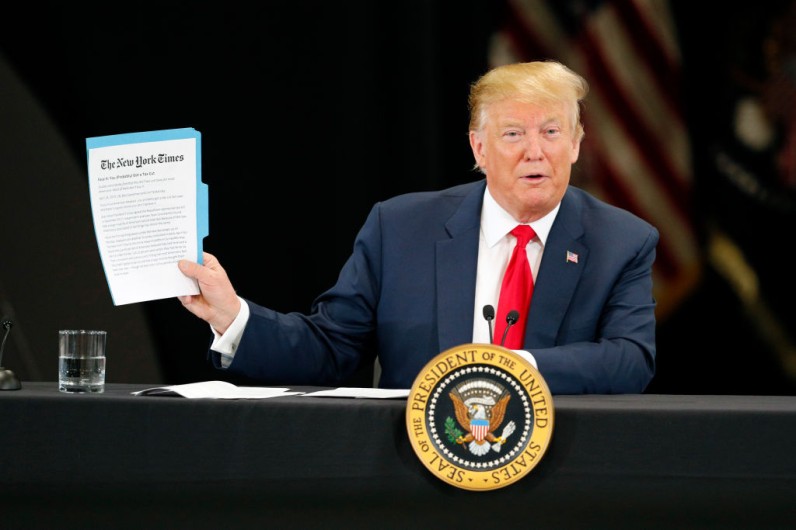

Tax Cuts of Donald Trump

According to CNN, the administration of former President Donald Trump hailed the tax cut law as a significant achievement during his first term. However, key individual and business tax provisions are scheduled to lapse by the end of 2025.

Trump has pledged to renew these provisions if re-elected in November's election. Extending the law permanently would primarily benefit households earning over $450,000, with the top 5% seeing a 3.2% increase in after-tax income.

READ NEXT : Donald Trump Promises Tax Cuts for America's Lower, Middle and Upper Classes if He Returns to White House

Average Tax Cuts

By 2027, those in the top 1% earning at least $1 million would receive an average tax cut of about $70,000. For the top 0.1% earning $5 million or more, the average tax cut would be nearly $280,000, about 3% of their after-tax income.

Middle-income households earning between $65,000 and $116,000 would receive an average tax cut of around $1,000, equivalent to 1.3% of their income. According to the analysis, extending the 2017 tax law would cut taxes for about three-quarters of households but increase them by around 10%.

Join the Conversation